How will relative valuation impact the performance of Canada's latest tech IPO?

Over the course of his nine years as Chief Executive Officer of Waterloo’s Descartes Systems (DSG:TSX), Art Mesher would always remind Canadian institutional investors about the relative valuations of Canadian and U.S.-based software companies. It galled him, circa 2010, that a Canadian small/midcap software company with attractive attributes would be valued substantially lower than the same type/size of firm south of the border.

By the end of his tenure in 2013, that Canadian discount had finally narrowed. Whether it was due to his evangelizing, or a byproduct of ongoing bargain-hunting M&A activity, the day came when firms such as Descartes could look at their U.S. comps and feel comfortable about relative valuations in North America.

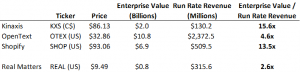

On the heels of the successful Kinaxis (C$13 to C$86) and Shopify (US$17 to US$93) IPOs, all in the space of just two years, it appears that the “Canadian discount” might be a thing of the past for our best-and-brightest. As Real Matters (REAL:TSX) begins trading today, I thought I’d have a look at the relative valuation of our Wellington Financial Fund III portfolio company as compared to three of the household tech names (KXS, OTC/OTEX and SHOP) that are owned by many Canadian institutional investors (I converted RM’s C$ share price to US$ as its financials are reported in US$).

For all of the hand-ringing about the top seven institutional buyers of the Real Matters IPO being Canadian money managers (see prior post “Can you have too much ‘Cancon’ in your TSX IPO?” May 8-17), you can see why: a very attractive valuation relative to other obvious names. Research analysts well know that Real Matters’ revenue isn’t pure software, as banks and insurance companies use Real Matters’ software platform to acquire certain valuation services, which are charged as a package. That’s why KXS and SHOP achieve far higher multiples. Open Text might be seen as a better comparable, given the larger services component of its business, but it is a slow-grower (at least organically). Which reintroduces faster-growing KXS and SHOP to the comparable valuation conversation. While none of KXS, OTEX and SHOP are pure comps, these will invariably be some of the names that investors and analysts will be considering this morning when Real Matters CEO Jason Smith rings the bell at the Toronto Stock Exchange at 9:30 a.m.

Whether it was valued on a trailing 12 month revenue or on a run-rate basis, and despite the bifurcated nature of the revenue base, you can see — from a relative valuation standpoint — why Mr. Smith’s IPO was seven times oversubscribed.

Congratulations to all involved.

MRM

(disclosure: our Fund III has equity securities in RM, and I bought some personally via the IPO)

Dear Mark,

I am an investor in REAL as of Thursday. I have run the numbers and calculated the Enterprise Value of the co in USD (assuming 0.73 exch x 12.4 CAD closing px). My fully diluted EV came to 1.39 billion. Taking the 2017 $276 mil REV and applying 20% 17 growth one gets 331 mil USD run rate, I get a 4.2 multiple of EV/REV. I am assuming you are using the outstanding share count of 86 million in your calculation giving me approx $786 mil USD Mkt Cap and $689 mil USD EV. That spits out a 2.1 multiple. Any reason you don’t use the fully diluted EV? (I backed out cash after IPO and cancelled outstanding debt as they mentioned they would do so in the use of proceeds).

I am curious to get your opinion of why the IPO, fared poorly, seeing how it was an hotly anticipated issue at 7x oversubscription. Both SHOP and KXS initial two-day trading analysis and the subsequent weeks lead me to believe an off to the races start. Some things I thought of to piece together the price action: I myself thought the IPO was going to take place on Friday. I only found out Wednesday that it would in fact start trading Thurs. I consider myself to be quite in tuned with the financial media and if I missed it and thought it was floating Friday, I am sure the clear majority of investors thought the same thing. Without the retail support, there were no bids to support the stock at the $15 opening price.

Also, the “price stabilizer” did a poor job allowing the issue to break $13 a share and stay there into Friday close. Why? Negativity surrounding the upcoming earnings results no doubt displaying soft REV may have deterred some? HCG issues and the medias obsession over the past two weeks with the troubled alt lender tainting anything Real Estate related?

At the end of the day, achieving a $1 billion valuation for a Canadian IPO is a big issue. Perhaps the Canadian market is not as deep as we think and that the valuation discount divide has in fact widened again?

Curious to hear your thoughts. I will be listening in on the Monday call.

KR,

John